First trade of the new MIBGAS product, gas in Spain with price indexed to the Dutch price

13/09/2023

Since yesterday, September 12, 2023, MIBGAS agents can see on their screens the new MIBGAS products indexed to the TTF. The first trade was registered on the same day.

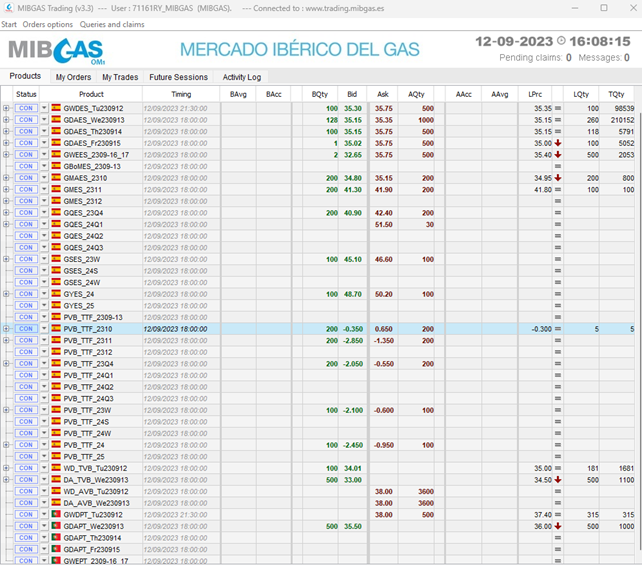

Chart: MIBGAS trading platform with the new products

In these products, gas is traded with physical delivery at the Spanish virtual point MIBGAS PVB, but its price is the Dutch virtual point TTF price for each day on which the gas is delivered plus a spread.

The first trade closed yesterday for this new product was for a gas contract with delivery in the month ahead. 5 MWh/day matched at a spread of -0.3 €/MWh. That is, for each day of October there is a physical delivery of 5 MWh from the seller to the buyer at a price that will be the closing price of the Dutch market for its daily product (Day-ahead) in €/MWh minus 0.3 €/MWh corresponding to the matched spread. With this operation, the buyer gets a gas cheaper than that existing on the Dutch market by €0.3/MWh for each day. Also, the seller ensures the sale of the matched quantity with a certain margin with respect to its procurement cost.

This guarantees the hedging of the trade made in Spain at the price recorded in the Dutch market (plus the spread). Thus, for example, if a trader has a gas supply indexed to the daily price of the Dutch market, he can place that gas in the Spanish market, in MIBGAS PVB, with a spread that guarantees an assured profit.

In short, since yesterday MIBGAS Derivatives agents have access to this new product (with different delivery periods) designed to facilitate their hedging operations and natural gas supply. These contracts are an effective tool for the risk management in the agents trading operations as they allow to simplify a complex operation that was traditionally carried out on several platforms into a single trade carried out on MIBGAS Derivatives. [1]

MIBGAS future contracts with delivery in PVB indexed to TTF Day-Ahead have different delivery periods (rest of month, month, quarter, semester, year) and are products with physical delivery and non-financial so they are outside MIFID II regulation. They are not settled by differences since the spread is fixed, the one corresponding to the matching. These contracts can be negotiated through MIBGAS Derivatives, both in the opening auction and in the continuous market, and they can also be registered as bilateral OTC trades.

In any case, to negotiate these contracts it is necessary to be registered in MIBGAS Derivatives. The access guide is available in the MIBGAS website: Access Guide to MIBGAS Derivatives

[1] Traditionally, market participants use the TTF for their risk management, which consists of hedging a trade made in MIBGAS (e.g. purchase of a monthly physical future in PVB) with the inverse trade made in the TTF with the same delivery period set in the purchase product (sale of a monthly physical future in TTF), thus ensuring the hedging of the product. Once the delivery date arrives and to avoid the physical delivery at the TTF, the market participant unfolds positions in the TTF. In this way they transform MIBGAS PVB price into TTF price.

The new MIBGAS contracts allow doing the same, but in a single operation by facilitating the hedging of trades at the PVB to the TTF price. Physical delivery at the PVB and indexation to the TTF simplifies trading and hedging in a single trade.