MIBGAS breaks its historical trading records in June, July and August

5/09/2022

MIBGAS's trading volume in June, July and August broke all records to date on the Iberian gas market platform. Over these three months, a total of 36.5 TWh was traded, compared to the 18.5 TWh for the same period last year, an increase of 100%.

In this very expensive and volatile summer in terms of energy prices, MIBGAS users reaffirmed their trust in the organised market, trading larger volumes of gas in MIBGAS in June, July and August while also obtaining the most competitive gas prices at a European level.

August saw the highest volume of trading in the history of MIBGAS, with 12,490 GWh registered across all its products (spot, prompt, futures and OTC) and in all its trading segments (Spanish and Portuguese virtual balance/trading points, the LNG Virtual Balance Tank, Virtual Balance Storage and registration of bilateral OTC transactions).

Gas prices in MIBGAS and the price differential with TTF

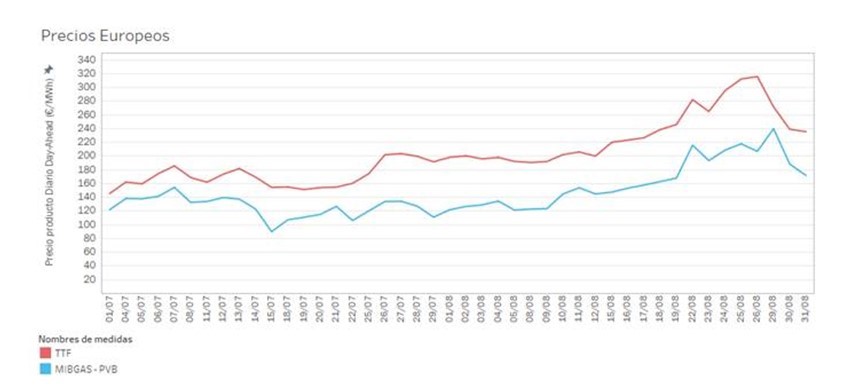

As far as prices were concerned, MIBGAS transactions in July and August closed at a significantly lower price than those of the Dutch TTF gas market, as can be seen in the following graph.

Graph 1. MIBGAS-TTF spread for July and August 2022.

The MIBGAS negative price differential relative to TTF was €57.58 in July and August, while the average TTF price was €203.09 compared with €145.51 for MIBGAS (for the daily D+1 product).

MIBGAS and its continuous liquidity promotion measures

In July, the LNG market driver began to act on the TVB Virtual Balance Tank. The role of the market driver is to launch a certain volume of bids to buy or sell gas (not both simultaneously) during the opening auction or short-term windows known by the other agents.

The market driver stimulates trading volume and is complemented by other arrangements put in place in MIBGAS to increase its liquidity, such as the market maker.

In short, MIBGAS is an attractive and competitive platform for voluntary use which is of great social benefit, as shown by the increase in its trading liquidity.